kentucky transfer tax calculator

This calculator can only provide you with a rough estimate of your tax liabilities based on the. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property.

What You Should Know About Santa Clara County Transfer Tax

Sold item category additional taxes depending on your location or the data may be outdated.

. Our calculator has been specially developed in order to provide the users of the calculator with not only. If your boat was registered in kentucky on january 1st of the current tax year you will be liable for the taxes under kentucky law krs 134810. Property taxes in Kentucky follow a one-year cycle beginning on Jan.

60000 income Single parent with one child - tax 3126. Health and Family Services. Actual amounts are subject to change based on tax rate changes.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Documentarty and Stock Transfer Taxes. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

The tax rate is the same no matter what filing status you use. Commission for Children with Special Health Care Needs. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. Payment shall be made to the motor vehicle owners County Clerk. Our income tax and paycheck calculator can help you understand your take home pay.

The median property tax on a 14590000 house is 131310 in Jefferson County. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. The median property tax on a 14590000 house is 105048 in Kentucky.

The median property tax on a 14590000 house is 153195 in the United States. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate. The tax is computed at the rate of 50 for each 500 of value or fraction thereof.

Motor Vehicle Usage Tax. 80000 income Married with two children - tax 3251. The median property tax on a 14520000 house is 149556 in Kenton County.

Maximum Possible Sales Tax. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded-in or 90 of the manufacturers suggested retail price MSRP. Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan.

Some areas do not have a county or local transfer tax rate. Delaware DE Transfer Tax. Overview of Kentucky Taxes.

Average Local State Sales Tax. General Administration and Program Support. It is levied at six percent and shall be paid on every motor vehicle used in.

Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. Kentucky Transfer Tax Calculator. For example the sale of a 200000 home would require a 200 transfer tax to be paid.

Select an Income Estimate. Kentucky transfer tax calculator Thursday June 2 2022 Edit. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202122.

Calculator Mode Calculate. C4513237 Residential for Lease 401458 Oakwood Ave from soldbyspiraca. Denotes required field.

All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property. 50000 income Married with one child - tax 2526. Kentucky sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Sales Tax calculator Kentucky. 25000 income Single with no children - tax 1136. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

Kentucky Property Tax Rules. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. A deed cannot be recorded unless the real estate transfer tax has been collected.

It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Local tax rates in Kentucky range from 600 making the sales tax range in Kentucky 600. 1 of each year.

Welcome to the TransferExcise Tax Calculator. The tax required to be levied by this section shall be collected only once on each transaction and in the county in which the property is conveyed or the greater part of the. If you are under age 60 at retirement and you have less than 27 years Kentucky Service your benefit will be less than the basic annuity estimated below.

3 a If any deed evidencing a transfer of title subject to the tax herein imposed is. Please see the KTRS pamphlet for Service Retirement. The median property tax on a 14520000 house is 104544 in Kentucky.

These fees are separate from. How Much Does It Really Cost To Sell A House In Kentucky Kentucky Real Estate Transfer Taxes An In Depth Guide Form 709 United States Gift And Generation Skipping Transfer Tax Return Transfer Tax In Marin County California Who Pays What. The median property tax on a 14520000 house is 152460 in the United States.

The base state sales tax rate in Kentucky is 6. Property Information Property State. The tax is collected by the county.

All rates are per 100. Please note that this is an estimated amount. Real estate in Kentucky is typically assessed through a mass appraisal.

The tax estimator above only includes a single 75 service fee. The State of Delaware transfer tax rate is 250. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

35000 income Single parent with one child - tax 1676. Find your Kentucky combined state and local tax rate. For most counties and cities in the Bluegrass State this is a percentage of taxpayers.

In those areas the state transfer tax rate would be 300. 2 A tax upon the grantor named in the deed shall be imposed at the rate of fifty cents 050 for each 500 of value or fraction thereof which value is declared in the deed upon the privilege of transferring title to real property. Category Percentage Amount.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. Kentucky imposes a flat income tax of 5.

Transfer Tax In San Diego County California Who Pays What

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

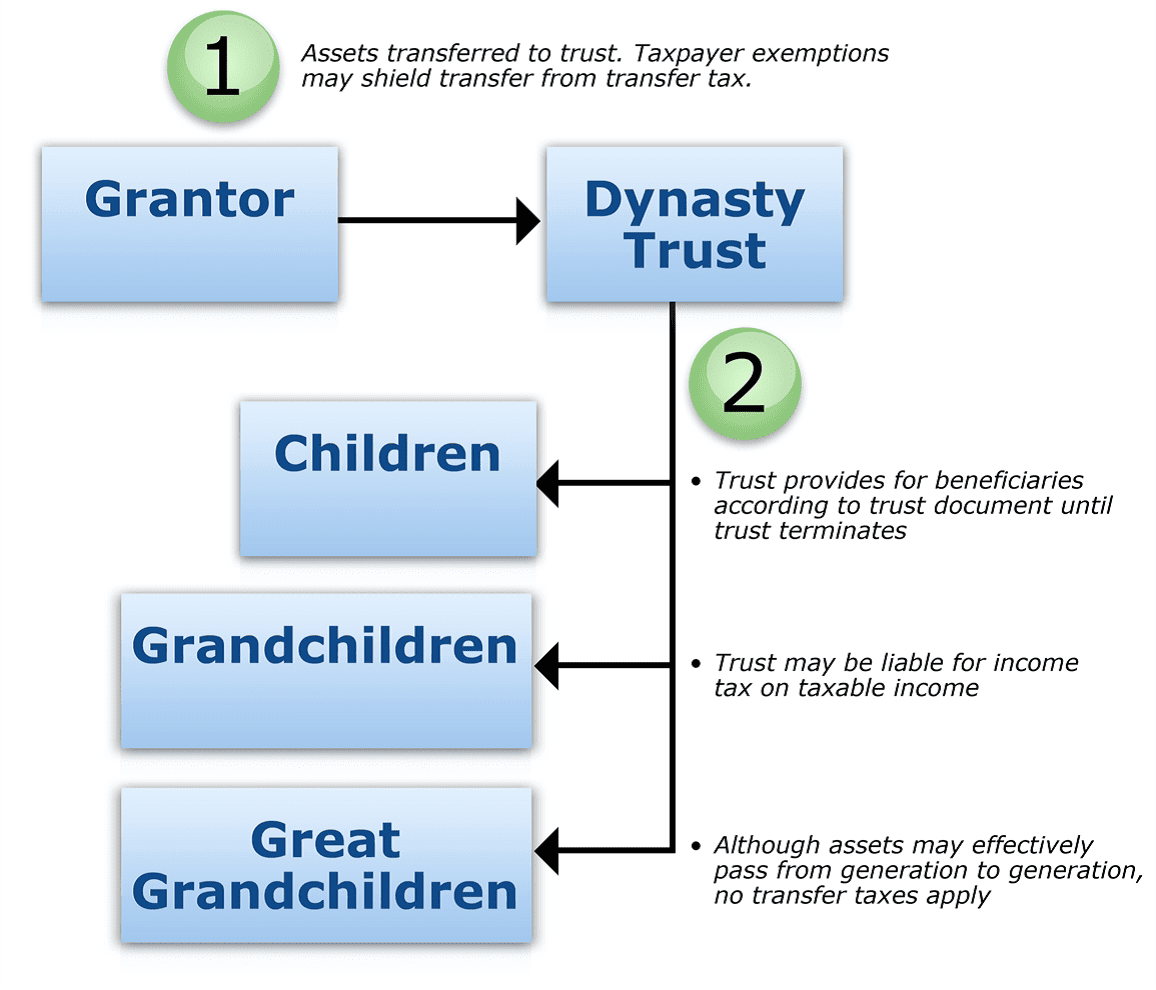

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How Much Does It Cost To Sell A House Zillow

Michael Stuart Webb Barrie Real Estate Land Transfer Tax

Transfer Tax Alameda County California Who Pays What

Car Tax By State Usa Manual Car Sales Tax Calculator

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

What Are The Seller Closing Costs In Kentucky Houzeo Blog

Dmv Fees By State Usa Manual Car Registration Calculator

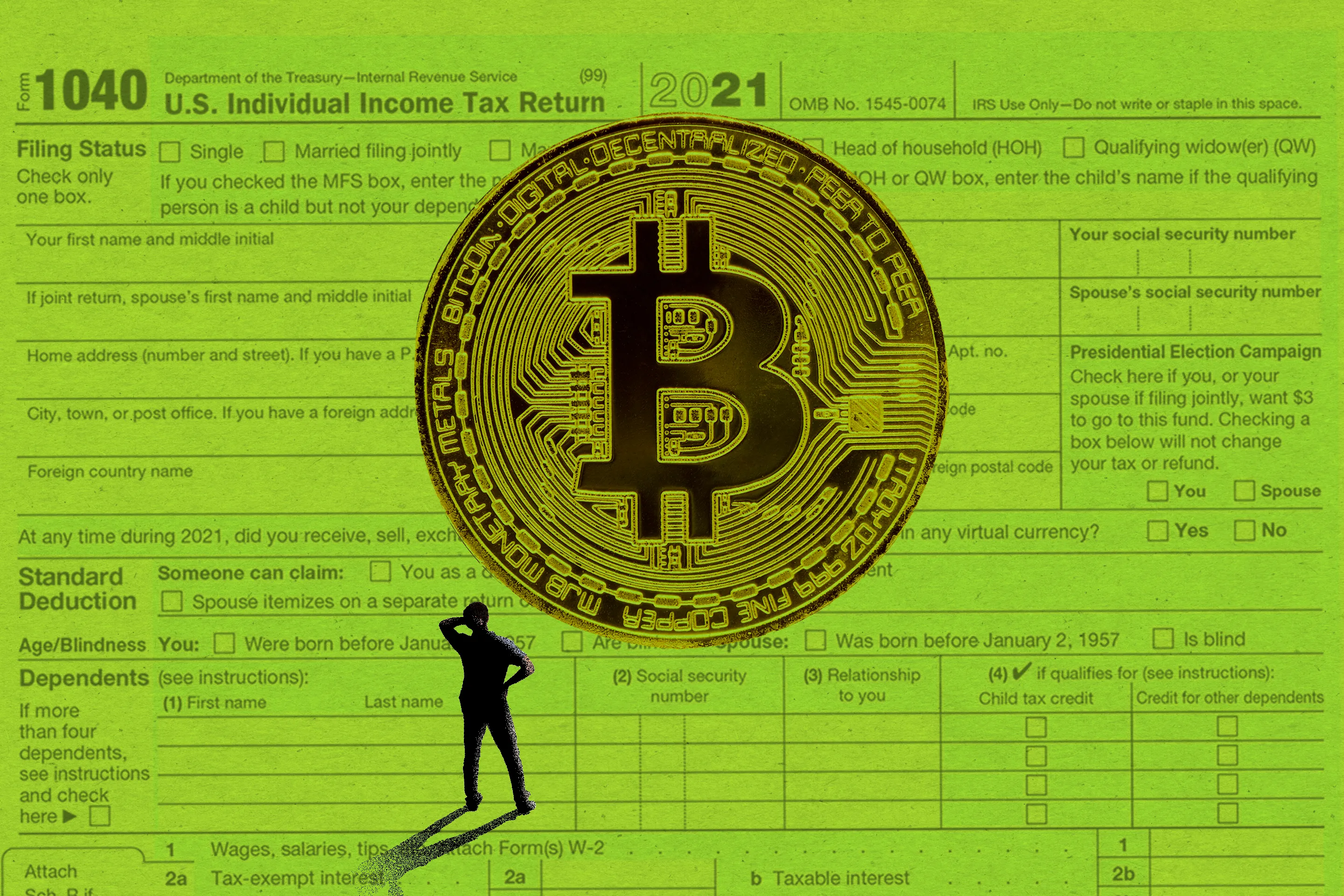

Crypto Taxes How To Calculate What You Owe To The Irs Money

Transfer Tax In San Luis Obispo County California Who Pays What

What You Should Know About Contra Costa County Transfer Tax

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Kentucky Real Estate Transfer Taxes An In Depth Guide